SECTION 1 – What does zakĀt mean and what are its rulings?

Part 1: The linguistic AND terminology definition of ZakĀt

- Linguistic definition of ZakĀt:

Zakāt means growth and increase. This meaning is derived from the Qurʾān which tells us that paying Zakāt purifies the believer from sins and increases his/her reward. Allah [God] ﷻ [ jalla jalāluhu:Great is His Majesty] says:

“Take from their wealth ˹O Prophet˺ charity to purify and bless them, and pray for them—surely your prayer is a source of comfort for them. And Allah is All-Hearing, All-Knowing.” – Qur’an: Repentance [Al Tawbah] 9:103

Zakāt also means blessing, praising, and improving/reforming. It is a form of purification [tazkīya] and the increase in it is the blessings Allah ﷻ gives. Zakāt of wealth means to give a part of money from the rich to the poor, whilst following certain conditions.

- Terminology definition of Zakāt:

The scholars have presented a variety of definitions from an Islamic point of view. However, the essence of its meaning does not alter through these different definitions.

| Schools of thought [Maḏhab] | Meaning of Zakāt |

| Hanafiyya | To give a certain amount of wealth from a person to another person [for the sake of Allah ﷻ]. |

| Malikiyya | To take a certain amount of wealth that has reached a threshold level [nisāb] after owning it for a year, and to be given to the one who is deserving of it. |

| Shāfʿiyya | The name given when a certain amount of wealth is taken from wealth with specific conditions and characteristics. |

| Hanabila | It is obligatory [wājib] to give certain amount of wealth with specific characteristics and time. A Muslim is obliged to pay Zakāt when they meet the right conditions. This is rightful wealth for the poor which will benefit them. |

From these definitions we can understand that Zakāt is obligatory [fard] and concerns wealth. A Muslim is obliged to pay Zakāt (a rightful wealth for the poor) when the conditions apply to them, and this will benefit the needy.

The Importance of Zaka

Abu Hurairah (May Allah be pleased with him) reported: The Messenger of Allah (ﷺ) said, “He who gives in charity the value of a date which he legally earned, and Allah accepts only that which is pure, Allah accepts it with His Right Hand and fosters it for him, as one of you fosters his mare, until it becomes like a mountain.” – Source: Al- Bukhāri and Muslim, Riyāḍ aṣ-Ṣāliḥīn 560 Introduction, Ḥadīth 560

Part 2: The ruling [Islamic Legal Proof] of Zakāt

- Zakāt is one of the pillars of Islam, and thus obligatory [farḍ] upon every Muslim.

- The proofs or evidence of Zakāt being obligatory [farḍ] are in in the Qur’an, sayings and actions of the Prophet ﷺ [Sunnah], consensus of scholars [ijmaʿ] and logic [mʿaqūl]

| SOURCES | |

| QURʾĀN | Zakāt was mentioned in the Qurʾān many times. It has been mentioned along with prayer [Ṣalāh] 26 times. Allah ﷻ commanded us to pay Zakāt: “And be steadfast in Salah, and pay Zakah, and bow down with those who bow.” – Qurʾān: The Cow [Al-Baqarah] 2:43 Allah ﷻ praised those who pay Zakāt: “Successful indeed are the believers. Those who humble themselves in their prayer. Those who avoid idle talk. And those who pay the Zakāt.” – Qurʾān: The Believers [Al-Muʾminun] 23: 1-4 Allah ﷻ warned against those reluctant to pay Zakāt: “O believers! Indeed, many rabbis and monks consume people’s wealth wrongfully and hinder others from the way of Allah. Give good news of a painful torment to those who hoard gold and silver and do not spend it in Allah’s cause. The Day will come when their treasure will be heated up in the Fire of Hell, and their foreheads, sides, and backs branded with it. It will be said to them, ‘This is the treasure you hoarded for yourselves. Now taste what you hoarded!’” – Qurʾān: Repentance [Al-Tawbah] 9:34-35 |

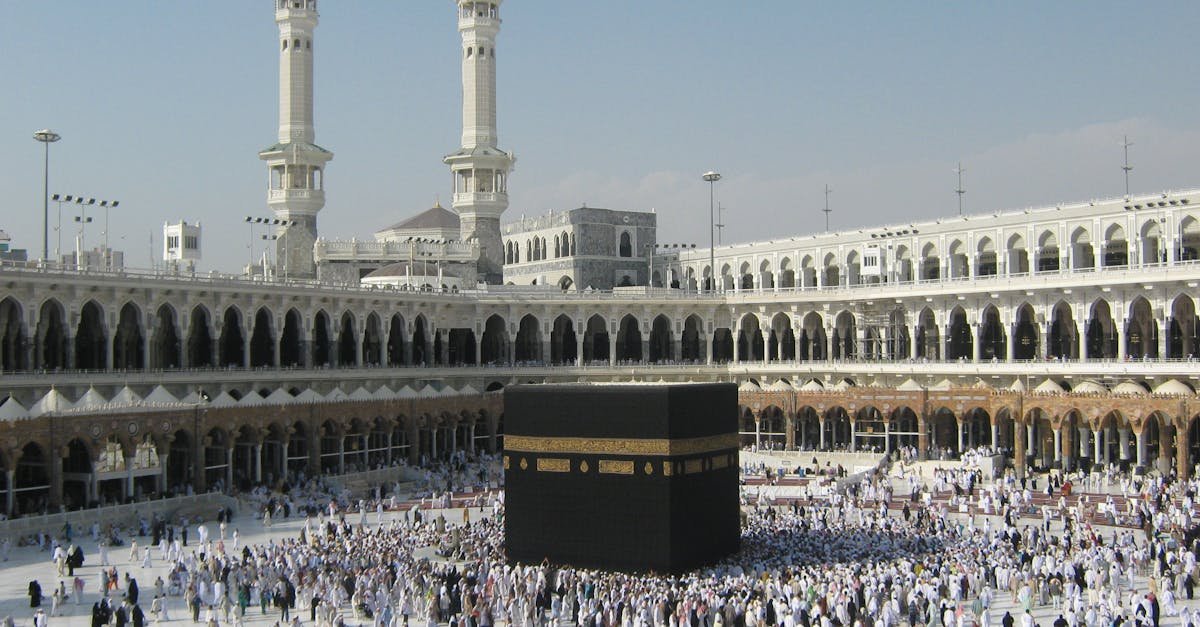

| SUNNAH | Following the Qurʾān, comes the Sunnah literature, where the obligatory nature of Zakāt is expressed in many narrations [aḥādīth]. Narrated Ibn ʿUmar: Allah’s Apostle said: Islam is based on (the following) five (principles): 1. To testify that none has the right to be worshipped but Allah and that Muhammad is Allah’s Apostle. 2. To offer the (compulsory congregational) prayers dutifully and perfectly. 3. To pay Zakāt (i.e. obligatory charity). 4. To perform Hajj. (i.e. Pilgrimage to Mecca) 5. To observe fast during the month of Ramadan. – Source: Saḥīḥ al-Bukhāri 1: Chapter 2, Ḥadīth 8 The Prophet ﷺ said; ‘those who stop giving Zakāt should be fought.’ After the death of the Prophet ﷺ, Abu Bakr رضى الله عنه [radiallāhu-ʿanhu] became the Caliphate, and he fought all those who had denied Zakāt and giving to the poor. |

| IJMAʿ | The scholars of Islam have come to a consensus that Zakāt is obligatory. It is logical and morally right to pay Zakāt as it means helping those in need (the weak, the disabled and the poor). The receiving of Zakāt strengthens them and allows them to perform their compulsory acts of worship. Therefore, the means for compulsory acts becomes compulsory. In other words, if a poor person is hungry, they are unable to carry out their compulsory worship until they are fed, and so paying Zakāt is obligatory. |

- The rulings and punishment for those who deny giving Zakāt:

According to Islamic Law [Sharīʿa], a believer is not allowed to cease paying Zakāt; if they do stop, they then expose themselves to Allah’s ﷻ anger, which is a grave sin. The ruling for those who do not give Zakāt will change according to certain conditions.

- Those who deny Zakāt, rejecting the belief that it is compulsory will be considered as an apostate [Murtad].

Imām Nawawīرَحْمَةُ الله عليه: Zakāt is one of the pillars of Islam, whoever denies or disbelieves in it becomes a disbeliever [kafir], except if he is new in Islam and does not know that it is compulsory. Therefore, he must be taught. Rawḍah al Ṭālibīn 3/2

- Whoever does not give Zakāt because of miserliness is not considered an apostate, but it should be taken from him by force.

Ibn Qudāma رَحْمَةُ الله عليه: If a person stops giving Zakāt, knowing that is compulsory, then if the imam is able to take it from him, he has the right to do so and he should also tell him off. Not giving Zakāt has punishment in this world and the next world.Source: [Book Mughanī 435/2]

The Prophet ﷺ has warned us that those who deny Zakāt will be punished in this life and the afterlife.

Narrated Abu Huraira: “Allah’s Apostle said, ‘Whoever is made wealthy by Allah and does not pay the Zakāt of his wealth, then on the Day of Resurrection his wealth will be made like a bald-headed poisonous male snake with two black spots over the eyes. The snake will encircle his neck and bite his cheeks and say, “I am your wealth, I am your treasure.”’ Then the Prophet recited the holy verses: — ‘Let not those who withhold . . .’ (to the end of the verse).’”(3.180). – Source: Saḥīḥ al-Bukhāri Volume 2, Book 24, Number 486

“And those who are miserly with what Allah has given them out of His grace should not take it as good for them. Instead, it is bad for them. They shall be forced, on the Doomsday, to put on round their necks the shackles of what they were miserly with. And to Allah belongs the inheritance of the heavens and the earth. And of what you do, Allah is All-Aware.” – Qurʾān: The Family of Imran [Al-ʾImrān] 3:180

SECTION 2: The role Zakāt plays in solving poverty or the problems of poverty

PART 1: Definition of Poverty [Faqr] – The Poor [Fuqarā] and the Needy [MasākĪn]

- Linguistic definition:

- Poverty is the opposite to wealth. A poor person in the eyes of the Arab is a person who is in need. The poor is the one who has little wealth. There are two types of poor: poor [faqīr] and needy [miskīn]. There is a difference of opinion in the definitions of these two terms. Who is in more need? The poor [faqīr] or the needy [miskīn]? Or are they the same in meaning?

- According to Muktār al-Sihāh al-Rāzi رَحْمَةُ الله عليه (page 508) the poor[faqīr] is in a better condition than the needy [miskīn]. There are disagreements to this as others oppose this and say it is the other way round, whilst some say there is no difference at all.

- Terminology definition:

According to the Hanafiyya and Malikiyya schools [maḏhāhib], the poor [faqīr] is a person who owns little or does not own enough for a living. The needy [miskīn] is the one who does not own anything.

According to the Shafʿiyya school [maḏhab], the poor [faqīr] is the one that has no wealth and no skills to benefit him/her. The needy [miskīn] has little wealth or skills, but it is not enough for him/her. [Kitāb Um- Imām al-Shāfiʿī 77/2]

The lesson from this is that the Zakāt will fulfil the needy whether he/she has nothing at all or has little but not enough.

Imām al-Ghazālī رَحْمَةُ الله عليه says in his book Revival of the Religious Sciences [Iḥyāʾ ʿUlūmu Dīn]: “Poverty [faqr] is to be deprived of what you need; however, to be deprived of what you do not need is not poverty.”

“Among those in the poor [fuqarā] and the needy [masākīn] categories is a woman who has no wealth and no one to look after her. The same is an orphan who has no money and no one to look after him/her; the disabled who is incapable of working and the elderly who cannot earn money due to their age; those who cannot find work and their money is not enough for them, or those who do work but do not earn enough.” [190/4 – Iḥyāʾ]

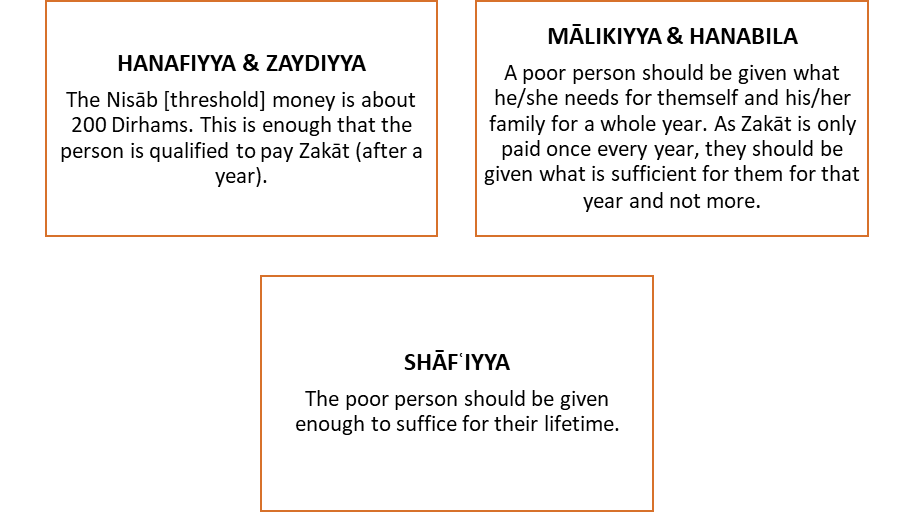

Part 2: The Amount that is given from Zakāt/The amount of Zakāt distributed

The Purpose of Zakāt:

The main purpose for collecting Zakāt is to rid society of poverty or decrease it to the lowest level. This allows a healthy economic balance, and closes the gap between the rich and the poor amongst the Muslims. To reach this goal, scholars research the amount of money that should be given to the poor from Zakāt. It is important to note that the aim of Zakāt is to ensure the poor person’s needs are covered and to reach a degree in which they are sufficient. Paying Zakāt purifies the wealth of the Muslims. It increases faith and allows a believer to fulfil their duty as a Muslim by upholding one of the five pillars of Islam.

SECTION 3: The wealth that should be given as Zakāt:

Part 1: The Zakāt of gold, silver & money [paper money].

Gold and silver are two expensive and valuable metals that the Arabs used to consider as a tool for buying and selling. This is how it was during the time of the Prophet ﷺ and was continued for many centuries. The Islamic Law [Sharīʿa] made it compulsory for Zakāt to be paid with gold and silver. This ruling is confirmed in the Qur’an, Sunnah and by consensus [ijmāʿ].

“O believers! Indeed, many rabbis and monks consume people’s wealth wrongfully and hinder ˹others˺ from the Way of Allah. Give good news of a painful torment to those who hoard gold and silver and do not spend it in Allah’s cause.” – Qur’an: Repentance [Al-Tawba] 9:34

“The Day ˹will come˺ when their treasure will be heated up in the Fire of Hell, and their foreheads, sides, and backs branded with it. ˹It will be said to them, “This is the treasure you hoarded for yourselves. Now taste what you hoarded!” – Qur’an: Repentance [Al-Tawba] 9:35

Abu Huraira reported Allah’s Messenger (May Peace be upon him) saying: ‘If any owner of gold or silver does not pay what is due on him, when the Day of Resurrection would come, plates of fire would be beaten out for him; these would then be heated in the fire of Hell and his sides, his forehead and his back would be cauterized with them. Whenever these cool down, (the process is) repeated during a day the extent of which would be fifty thousand years, until judgment is pronounced among servants, and he sees whether his path is to take him to Paradise or to Hell.’ – Source: Saḥīḥ Muslim: Ḥadīth 987a, page 449]

The scholars agreed it is compulsory to pay Zakāt in gold and silver. (Convincing in the subjects of ijmāʿ’) [Al Fasi 264,260/2]

Threshold of giving Zakāt – Nisab

To be liable for paying Zakāt, a person’s wealth must reach the threshold figure, called ‘niṣāb’. Niṣāb is measured through gold or silver. There has been change in the last couple of centuries where gold and silver have been replaced with paper money. However, we are obliged to adapt to this change and thus, Zakāt must be applied to the present currencies as this is what is used. The amount of Zakāt payable on gold and silver or paper money varies depending on the niṣāb value from year to year. [Al- Qaraḍāwī– Fiqh of Zakāt 193 – 197].

Part 2: Zakāt of Livestock

Zakāt must be paid on livestock such as, camels, cattle, sheep, and goats. These particular animals are of great benefit due to the fact that they give milk and reproduce, increasing one’s asset.

The Prophet (peace be upon him) said: “Any owner of camels, cows or sheep/goats that does not pay its due, on the day of resurrection they (the animals) will come to their owner in the best state of health they have ever had (in the world) and they will butt him with their horns and tread him with their hooves. [Definition of hoof: a horny covering of the feet of certain animals] and whenever the last of the herd is through, the first starts all over again. (And this will continue) until (all) mankind have been judged.” – Source: Saḥīḥ al-Bukhāri: Ḥadīth 1460 vol.1, page 322

The scholars agreed paying Zakāt through livestock – camels, cattle, sheep, and goats. [ijmāʿ]

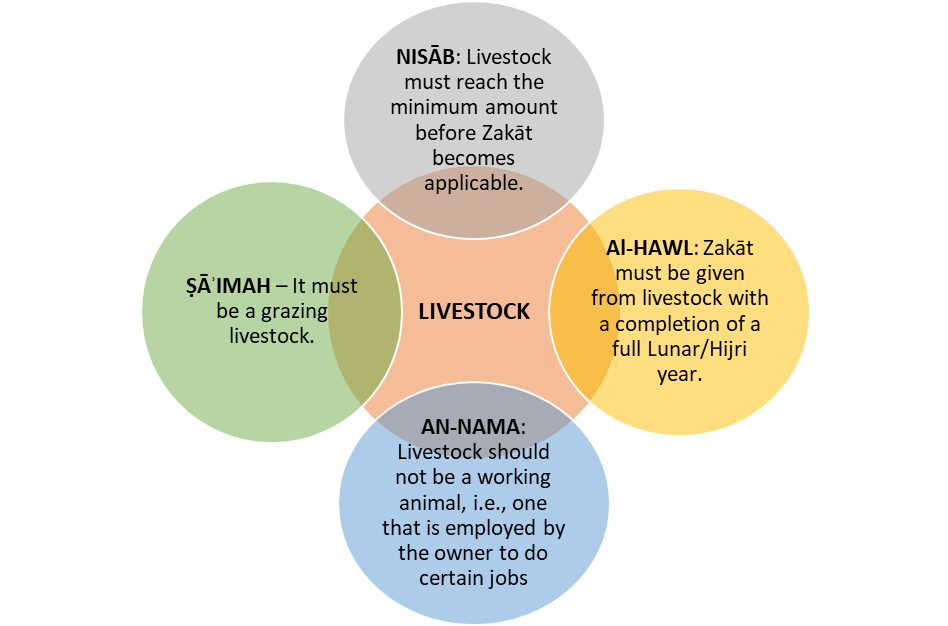

What are the conditions of the Zakāt of Livestock?

Notes: A working animal, such as one that carries goods, ploughs the land, produces milk or reproduces etc, is not applicable for Zakāt, even if they are free grazing according to the Hanafiyya, Shāfʿiyya and Hanbaliyya schools of thought [maḏhāhib].

- Contrarily, Imām Mālik states the working animal can still be used to offer Zakāt. [Tabarānī Ḥadīth]

- Another condition Imām Mālik has added is that the shepherd must have reached the age of maturity [bāligh]. If in the case of no other shepherds looking after the livestock, the livestock is not payable for Zakāt but should wait for a whole year.

- As- Ṣawm – the food the livestock eats from is wild plants (free grazing). If food is brought to them, so they are fed, Zakāt is not applicable.

Definitions of ṣāʾimah (taken from the word al- ṣawm): This refers to an animal that is free grazing from wild plants and this is enough for it, so it does not need to be fed. [Hanafiyya, Mālikiyya, Shāfʿiyya, Hanabala].

- Imām al-Shāfiʿī: The Zakāt should be given from those who graze freely most of the year, even if they were fed a little. However, if the feeding is more than the free grazing [ṣāʾimah] Zakāt is not applicable.

- Imām Abu Hanifa & Imām Ahmed bin Hanbal: Ṣāʾimah is the one that is sufficiently grazing from the wilderness. If the owner feeds it, either half or more than a year, it is not considered ṣāʾimah, thus Zakāt is not applicable.

- Imām Mālik: It does not matter whether it is fully free-grazing [ṣāʾimah] or half – you still have to give Zakāt – why? Because there is no word relating to free-grazing [ṣāʾimah] in the ḥadīthliterature because the Arabs had nothing but thatfor their animals

- There is disagreement about the duration of the free grazing [ṣāʾimah] that makes it compulsory for Zakāt.

Working animals that are used to carry heavy loads/goods, or to lift or plough the ground do not need to have Zakāt paid on them, even if they are free-grazing (according to the Hanafiyya, Shāfʿiyya and Hanabala schools).

According to the Mālikiyya school [maḏhab]: Working animals will not stop the individual from giving Zakāt.

- New-born livestock are excluded from the condition of the completion of a full year [Al-Hawl]. If they give birth during the year, a full completed year doesn’t apply, Zakāt is paid when the Zakāt for the mother is due.

THE NISĀB OF LIVESTOCK

- Livestock [Al-ʾAnʿām] = camel, cattle, sheep & goat

CAMEL:

| NUMBER OF CAMELS | ZAKĀT PAYMENT |

| 5 – 9 | One sheep/goat [SHĀH] – Must be a 1-year-old sheep or a 2-year-old goat |

| 10 – 14 | Two 1-year old sheep or two 2-year-old goats |

| 15 – 19 | Three 1-year old sheep or three 2-year-old goats |

| 20 – 24 | Four 1-year old sheep or four 2-year-old goats |

| 25 – 35 | One 2-year-old camel that has not entered its 2nd year – BINT MUKHĀḌ |

| 36 – 45 | One camel that has not entered its 3rd year – BINT LABŪN |

| 46 – 60 | One female camel that gone into its 4th year – HIQAH |

| 61 – 75 | One female camel that has gone into its 5th year – JADHʿAH |

| 76 – 90 | Two BINT LABŪN |

| 91 – 120 | Two HIQAH |

| 120 + | For every 40 camels, you give one BINT LABŪN. For every 50 camels – You give one HIQAH. |

| 170 + | After two years, in every year, you give: 3 BINT LABŪN, and 1 HIQAH. 3 BANĀT LABŪN [120], and 1 HIQAH [50] = 17 |

Narrated Anas: When Abu Bakr; sent me to (collect the Zakāt from) Bahrain, he wrote to me the following: — (In the name of Allah, the Beneficent, the Merciful). These are the orders for compulsory charity (Zakāt) which Allah’s Messenger ﷺ had made obligatory for every Muslim, and which Allah had ordered His Apostle ﷺ to observe: Whoever amongst the Muslims is asked to pay Zakāt accordingly, he should pay it (to the Zakāt collector) and whoever is asked more than that (what is specified in this script) he should not pay it; for twenty-four camels or less, sheep are to be paid as Zakāt; for every five camels one sheep is to be paid, and if there are between twenty-five to thirty-five camels, one Bint Mukhāḍ is to be paid; and if they are between thirty-six to forty-five (camels), one Bint Labūn is to be paid; and if they are between forty-six to sixty (camels), one Hiqqa is to be paid; and if the number is between sixty-one to seventy-five (camels), one Jadhʿah is to be paid; and if the number is between seventy-six to ninety (camels), two Bint Labūns are to be paid; and if they are from ninety-one to one-hundred and twenty (camels), two Hiqāts are to be paid; and if they are over one-hundred and-twenty (camels), for every forty (over one-hundred-and-twenty) one Bint Labūn is to be paid, and for every fifty camels (over one-hundred-and-twenty) one Hiqah is to be paid; and whoever has got only four camels, has to pay nothing as Zakāt, but if the owner of these four camels wants to give something, he can. If the number of camels increases to five, the owner has to pay one sheep as Zakāt… [Saḥīḥ al-Bukhāri 1454i: Book 23, Ḥadīth 57, vol.2, Book 24, Ḥadīth 534]

Cattle:

| NUMBER OF CATTLE | ZAKĀT PAYMENT |

| Less than 30 | No Zakāt |

| 30 – 39 | One cow that has reached 1 year – TABĪʿ |

| 40 – 59 | One cow that has reached 2 years – MUSINNAH |

| 60 – 69 | Two cows that have reached 1 year – TABĪʿĀN |

| 70 – 79 | 1 TABĪʿand 1 MUSINNAH |

| 80 – 89 | 2 MUSINNAH |

| 90 – 99 | 3 ATBIʿAH [plural of TABĪʿ] |

| 100 – 109 | 1 MUSINNAH and TABĪʿ |

| 110 – 119 | 2 MUSINNĀT and 1 TABĪʿ |

| 119 + | For every 30 cows give 1 TABĪʿ, and for every 40 give MUSINNĀT |

Mu ʿādh bin Jabal (RAA) narrated, ‘When the Messenger of Allah (ﷺ) sent him to Yemen, he commanded him to take a tabīʿ (young bull) or tabīʿah (young cow, which is one year old), as Zakāt for every 30 cows. And for every forty cows, a musinnah (two-year-old cow) is due. Every non-Muslim who attained the age of puberty should pay one Dinār or the equivalent from the Muʿāfiri clothes (made in a town in Yemen called Maʿāfir).’ – Source: Related by the Five Imams and the wording is from Aḥmad: [Book 4, Ḥadīth 3; Book 4, Ḥadīth 625; Book 4, Ḥadīth 600]

SHEEP & GOAT:

| NUMBER OF SHEEP & GOAT | ZAKĀT PAYMENT |

| Less than 40 | No Zakāt |

| For every 40 | It is compulsory to give 1 |

| 41 – 120 | One 1-year old sheep or one 2-year-old goat |

| 121 – 200 | Two sheep |

| 201 – 300 | Three sheep |

| 300+ | For every 100, you give one sheep |

It was narrated from Ibn Shihāb, from Sālim bin ʿAbdullah, from his father, from the Messenger of Allah: Sālim said: “My father read to me a letter that the Messenger of Allah (ﷺ) had written about Sadaqat before Allah caused him to pass away. I read in it: ‘For forty sheep, one sheep, up to one hundred and twenty. If there is more than that – even one – then two sheep, up to two hundred. If there is one more than that – even one = then three sheep, up to three hundred. If there are many sheep, then for each hundred, one sheep.’ And I read in it: ‘Separate flocks should not be combined, and a combined flock should not be separated.’ And I read in it: ‘And a male goat should not be taken for Sadaqah, nor a decrepit nor defective animal.’” – Source: Sunan Ibn Mājah 1805: Book 8, Ḥadīth 23, Vol. 3, Book 8, Ḥadīth 1805

Part 3: Zakāt of Crops & Fruits

Agricultural produce, such as crops, and fruits are subject to Zakāt. This is mentioned in the Qurʾān, Sunnah and consensus [ijmāʿ]’.

“You who believe, give charitably from the good things you have acquired and that We have produced for you from the earth. Do not give away the bad things that you yourself would only accept with your eyes closed: remember that God is self-sufficient, worthy of all praise.” – Qur’an: The Cow [Baqarah] 2: 267

It was narrated from Salim, from his father, that the Messenger of Allah (Peace be upon him) said, “For whatever is irrigated by the sky, rivers, and springs, or draws up water from deep roots, one-tenth. For whatever is irrigated by animals and artificial means, one half of one-tenth.” – Source: Sunan an-Nasāʾī 2488: Ḥadīth 54 vol.3, Book 23, Ḥadīth 2490

The scholars agreed it is compulsory to give Zakāt from crops and fruits – ijmāʿ [Mālik al Mudawana, 294/1]

However, although the scholars agreed upon crops and fruits as payable Zakāt, they differed on the types of crops and fruits. The great imams رحمة الله عليهم, Imām Mālik, Imām al-Shāfiʿī and Imām Aḥmad bin Hanbal all agreed it is obligatory to give everything that you can eat and store as a form of Zakāt.

SECTION 4 – The Resources [Mawārid] of Zakāt and its entitlement:

Part 1: The Resource of Zakāt and the way to expend it

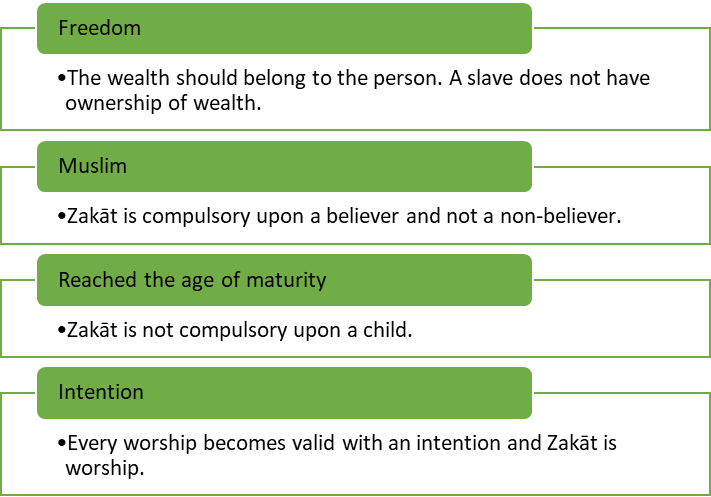

The amount of goods for Zakāt in Islam is great and varies. However, we are not liable to pay Zakāt until specific conditions are fulfilled. There are conditions upon the person giving the Zakāt, and conditions upon their wealth.

The conditions of the person giving Zakāt:

The conditions of the wealth Zakāt is taken from:

- Absolute ownership – that the individual has complete ownership of the wealth allowing them to benefit from it.

- Growth – that the wealth grows in a way that will profit the owner.

- Freedom from debt – that the wealth is free from debt, particularly compulsory Zakāt ul-ʿayn – such as, gold, money etc. There are different opinions on this in the four schools [maḏhāhib]. For example, in the Hanafi Maḏhab, a person must pay Zakāt if their wealth, after deducting immediate debts, exceeds the minimum threshold [nisāb]. On the other hand, the Māliki Maḏhab states that debts do not exempt a person from paying Zakāt even if they reduce the person’s wealth below the minimum threshold [nisāb].

- Threshold [nisāb] – that the wealth reaches the threshold level for payable Zakāt. If the wealth of the individual reaches this, Zakāt becomes compulsory upon them.

- Lunar year – that there is passing of a complete year of the Islamic lunar [Hijrī] calendar before Zakāt is owed. An exception is gains from the earth/agricultural produce.

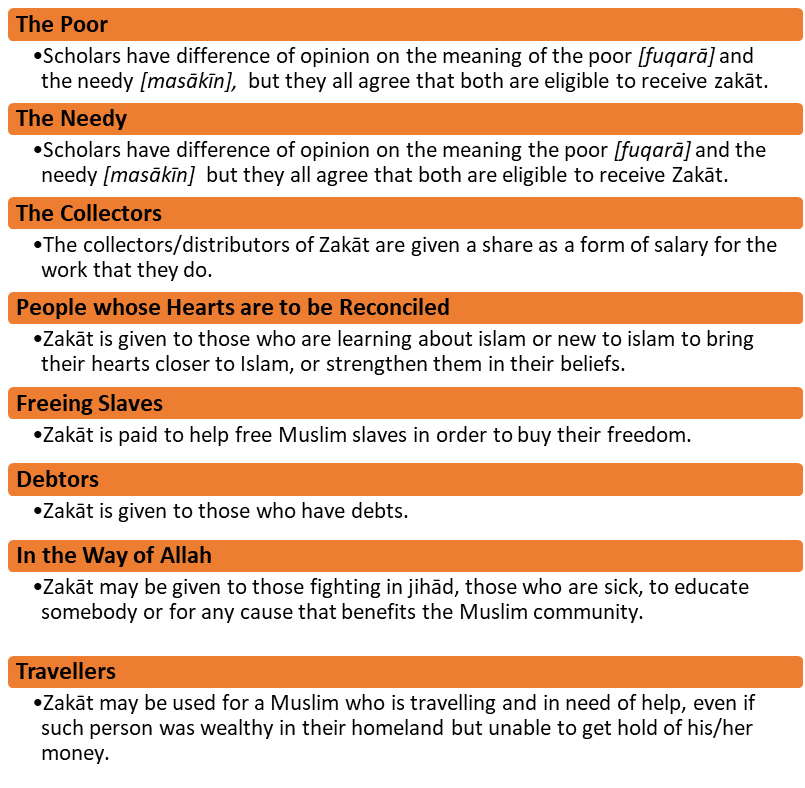

The Recipients of Zakāt:

Zakāt must be distributed to eight groups of people as commanded to us by Allah Almighty ﷻ.

“Alms are meant only for the poor, and the needy, and those who collect them, and those whose hearts are to be reconciled, and to free captives and the debtors, and for the cause of Allah, and (for) the wayfarer; a duty imposed by Allah. Allah is Knower, Wise.” – Qurʾān: Repentance [Al-Tawba] 9:60

REFERENCES:

Dr Nawal al Maghrebi

Bewley, A. & Abdalhakim-Doughlas, A. [2001] Zakāt: Raising A Fallen Pillar. Black Stone Press, Norwich (UK).

SECTION 1 – What does zakĀt mean and what are its rulings?

Part 1: The linguistic AND terminology definition of ZakĀt

- Linguistic definition of ZakĀt:

Zakāt means growth and increase. This meaning is derived from the Qurʾān which tells us that paying Zakāt purifies the believer from sins and increases his/her reward. Allah [God] ﷻ [ jalla jalāluhu:Great is His Majesty] says:

“Take from their wealth ˹O Prophet˺ charity to purify and bless them, and pray for them—surely your prayer is a source of comfort for them. And Allah is All-Hearing, All-Knowing.” – Qur’an: Repentance [Al Tawbah] 9:103

Zakāt also means blessing, praising, and improving/reforming. It is a form of purification [tazkīya] and the increase in it is the blessings Allah ﷻ gives. Zakāt of wealth means to give a part of money from the rich to the poor, whilst following certain conditions.

- Terminology definition of Zakāt:

The scholars have presented a variety of definitions from an Islamic point of view. However, the essence of its meaning does not alter through these different definitions.

| Schools of thought [Maḏhab] | Meaning of Zakāt |

| Hanafiyya | To give a certain amount of wealth from a person to another person [for the sake of Allah ﷻ]. |

| Malikiyya | To take a certain amount of wealth that has reached a threshold level [nisāb] after owning it for a year, and to be given to the one who is deserving of it. |

| Shāfʿiyya | The name given when a certain amount of wealth is taken from wealth with specific conditions and characteristics. |

| Hanabila | It is obligatory [wājib] to give certain amount of wealth with specific characteristics and time. A Muslim is obliged to pay Zakāt when they meet the right conditions. This is rightful wealth for the poor which will benefit them. |

From these definitions we can understand that Zakāt is obligatory [fard] and concerns wealth. A Muslim is obliged to pay Zakāt (a rightful wealth for the poor) when the conditions apply to them, and this will benefit the needy.

The Importance of Zaka

Abu Hurairah (May Allah be pleased with him) reported: The Messenger of Allah (ﷺ) said, “He who gives in charity the value of a date which he legally earned, and Allah accepts only that which is pure, Allah accepts it with His Right Hand and fosters it for him, as one of you fosters his mare, until it becomes like a mountain.” – Source: Al- Bukhāri and Muslim, Riyāḍ aṣ-Ṣāliḥīn 560 Introduction, Ḥadīth 560

Part 2: The ruling [Islamic Legal Proof] of Zakāt

- Zakāt is one of the pillars of Islam, and thus obligatory [farḍ] upon every Muslim.

- The proofs or evidence of Zakāt being obligatory [farḍ] are in in the Qur’an, sayings and actions of the Prophet ﷺ [Sunnah], consensus of scholars [ijmaʿ] and logic [mʿaqūl]

| SOURCES | |

| QURʾĀN | Zakāt was mentioned in the Qurʾān many times. It has been mentioned along with prayer [Ṣalāh] 26 times. Allah ﷻ commanded us to pay Zakāt: “And be steadfast in Salah, and pay Zakah, and bow down with those who bow.” – Qurʾān: The Cow [Al-Baqarah] 2:43 Allah ﷻ praised those who pay Zakāt: “Successful indeed are the believers. Those who humble themselves in their prayer. Those who avoid idle talk. And those who pay the Zakāt.” – Qurʾān: The Believers [Al-Muʾminun] 23: 1-4 Allah ﷻ warned against those reluctant to pay Zakāt: “O believers! Indeed, many rabbis and monks consume people’s wealth wrongfully and hinder others from the way of Allah. Give good news of a painful torment to those who hoard gold and silver and do not spend it in Allah’s cause. The Day will come when their treasure will be heated up in the Fire of Hell, and their foreheads, sides, and backs branded with it. It will be said to them, ‘This is the treasure you hoarded for yourselves. Now taste what you hoarded!’” – Qurʾān: Repentance [Al-Tawbah] 9:34-35 |

| SUNNAH | Following the Qurʾān, comes the Sunnah literature, where the obligatory nature of Zakāt is expressed in many narrations [aḥādīth]. Narrated Ibn ʿUmar: Allah’s Apostle said: Islam is based on (the following) five (principles): 1. To testify that none has the right to be worshipped but Allah and that Muhammad is Allah’s Apostle. 2. To offer the (compulsory congregational) prayers dutifully and perfectly. 3. To pay Zakāt (i.e. obligatory charity). 4. To perform Hajj. (i.e. Pilgrimage to Mecca) 5. To observe fast during the month of Ramadan. – Source: Saḥīḥ al-Bukhāri 1: Chapter 2, Ḥadīth 8 The Prophet ﷺ said; ‘those who stop giving Zakāt should be fought.’ After the death of the Prophet ﷺ, Abu Bakr رضى الله عنه [radiallāhu-ʿanhu] became the Caliphate, and he fought all those who had denied Zakāt and giving to the poor. |

| IJMAʿ | The scholars of Islam have come to a consensus that Zakāt is obligatory. It is logical and morally right to pay Zakāt as it means helping those in need (the weak, the disabled and the poor). The receiving of Zakāt strengthens them and allows them to perform their compulsory acts of worship. Therefore, the means for compulsory acts becomes compulsory. In other words, if a poor person is hungry, they are unable to carry out their compulsory worship until they are fed, and so paying Zakāt is obligatory. |

- The rulings and punishment for those who deny giving Zakāt:

According to Islamic Law [Sharīʿa], a believer is not allowed to cease paying Zakāt; if they do stop, they then expose themselves to Allah’s ﷻ anger, which is a grave sin. The ruling for those who do not give Zakāt will change according to certain conditions.

- Those who deny Zakāt, rejecting the belief that it is compulsory will be considered as an apostate [Murtad].

Imām Nawawīرَحْمَةُ الله عليه: Zakāt is one of the pillars of Islam, whoever denies or disbelieves in it becomes a disbeliever [kafir], except if he is new in Islam and does not know that it is compulsory. Therefore, he must be taught. Rawḍah al Ṭālibīn 3/2

- Whoever does not give Zakāt because of miserliness is not considered an apostate, but it should be taken from him by force.

Ibn Qudāma رَحْمَةُ الله عليه: If a person stops giving Zakāt, knowing that is compulsory, then if the imam is able to take it from him, he has the right to do so and he should also tell him off. Not giving Zakāt has punishment in this world and the next world.Source: [Book Mughanī 435/2]

The Prophet ﷺ has warned us that those who deny Zakāt will be punished in this life and the afterlife.

Narrated Abu Huraira: “Allah’s Apostle said, ‘Whoever is made wealthy by Allah and does not pay the Zakāt of his wealth, then on the Day of Resurrection his wealth will be made like a bald-headed poisonous male snake with two black spots over the eyes. The snake will encircle his neck and bite his cheeks and say, “I am your wealth, I am your treasure.”’ Then the Prophet recited the holy verses: — ‘Let not those who withhold . . .’ (to the end of the verse).’”(3.180). – Source: Saḥīḥ al-Bukhāri Volume 2, Book 24, Number 486

“And those who are miserly with what Allah has given them out of His grace should not take it as good for them. Instead, it is bad for them. They shall be forced, on the Doomsday, to put on round their necks the shackles of what they were miserly with. And to Allah belongs the inheritance of the heavens and the earth. And of what you do, Allah is All-Aware.” – Qurʾān: The Family of Imran [Al-ʾImrān] 3:180

SECTION 2: The role Zakāt plays in solving poverty or the problems of poverty

PART 1: Definition of Poverty [Faqr] – The Poor [Fuqarā] and the Needy [MasākĪn]

- Linguistic definition:

- Poverty is the opposite to wealth. A poor person in the eyes of the Arab is a person who is in need. The poor is the one who has little wealth. There are two types of poor: poor [faqīr] and needy [miskīn]. There is a difference of opinion in the definitions of these two terms. Who is in more need? The poor [faqīr] or the needy [miskīn]? Or are they the same in meaning?

- According to Muktār al-Sihāh al-Rāzi رَحْمَةُ الله عليه (page 508) the poor[faqīr] is in a better condition than the needy [miskīn]. There are disagreements to this as others oppose this and say it is the other way round, whilst some say there is no difference at all.

- Terminology definition:

According to the Hanafiyya and Malikiyya schools [maḏhāhib], the poor [faqīr] is a person who owns little or does not own enough for a living. The needy [miskīn] is the one who does not own anything.

According to the Shafʿiyya school [maḏhab], the poor [faqīr] is the one that has no wealth and no skills to benefit him/her. The needy [miskīn] has little wealth or skills, but it is not enough for him/her. [Kitāb Um- Imām al-Shāfiʿī 77/2]

The lesson from this is that the Zakāt will fulfil the needy whether he/she has nothing at all or has little but not enough.

Imām al-Ghazālī رَحْمَةُ الله عليه says in his book Revival of the Religious Sciences [Iḥyāʾ ʿUlūmu Dīn]: “Poverty [faqr] is to be deprived of what you need; however, to be deprived of what you do not need is not poverty.”

“Among those in the poor [fuqarā] and the needy [masākīn] categories is a woman who has no wealth and no one to look after her. The same is an orphan who has no money and no one to look after him/her; the disabled who is incapable of working and the elderly who cannot earn money due to their age; those who cannot find work and their money is not enough for them, or those who do work but do not earn enough.” [190/4 – Iḥyāʾ]

Part 2: The Amount that is given from Zakāt/The amount of Zakāt distributed

The Purpose of Zakāt:

The main purpose for collecting Zakāt is to rid society of poverty or decrease it to the lowest level. This allows a healthy economic balance, and closes the gap between the rich and the poor amongst the Muslims. To reach this goal, scholars research the amount of money that should be given to the poor from Zakāt. It is important to note that the aim of Zakāt is to ensure the poor person’s needs are covered and to reach a degree in which they are sufficient. Paying Zakāt purifies the wealth of the Muslims. It increases faith and allows a believer to fulfil their duty as a Muslim by upholding one of the five pillars of Islam.

SECTION 3: The wealth that should be given as Zakāt:

Part 1: The Zakāt of gold, silver & money [paper money].

Gold and silver are two expensive and valuable metals that the Arabs used to consider as a tool for buying and selling. This is how it was during the time of the Prophet ﷺ and was continued for many centuries. The Islamic Law [Sharīʿa] made it compulsory for Zakāt to be paid with gold and silver. This ruling is confirmed in the Qur’an, Sunnah and by consensus [ijmāʿ].

“O believers! Indeed, many rabbis and monks consume people’s wealth wrongfully and hinder ˹others˺ from the Way of Allah. Give good news of a painful torment to those who hoard gold and silver and do not spend it in Allah’s cause.” – Qur’an: Repentance [Al-Tawba] 9:34

“The Day ˹will come˺ when their treasure will be heated up in the Fire of Hell, and their foreheads, sides, and backs branded with it. ˹It will be said to them, “This is the treasure you hoarded for yourselves. Now taste what you hoarded!” – Qur’an: Repentance [Al-Tawba] 9:35

Abu Huraira reported Allah’s Messenger (May Peace be upon him) saying: ‘If any owner of gold or silver does not pay what is due on him, when the Day of Resurrection would come, plates of fire would be beaten out for him; these would then be heated in the fire of Hell and his sides, his forehead and his back would be cauterized with them. Whenever these cool down, (the process is) repeated during a day the extent of which would be fifty thousand years, until judgment is pronounced among servants, and he sees whether his path is to take him to Paradise or to Hell.’ – Source: Saḥīḥ Muslim: Ḥadīth 987a, page 449]

The scholars agreed it is compulsory to pay Zakāt in gold and silver. (Convincing in the subjects of ijmāʿ’) [Al Fasi 264,260/2]

Threshold of giving Zakāt – Nisab

To be liable for paying Zakāt, a person’s wealth must reach the threshold figure, called ‘niṣāb’. Niṣāb is measured through gold or silver. There has been change in the last couple of centuries where gold and silver have been replaced with paper money. However, we are obliged to adapt to this change and thus, Zakāt must be applied to the present currencies as this is what is used. The amount of Zakāt payable on gold and silver or paper money varies depending on the niṣāb value from year to year. [Al- Qaraḍāwī– Fiqh of Zakāt 193 – 197].

Part 2: Zakāt of Livestock

Zakāt must be paid on livestock such as, camels, cattle, sheep, and goats. These particular animals are of great benefit due to the fact that they give milk and reproduce, increasing one’s asset.

The Prophet (peace be upon him) said: “Any owner of camels, cows or sheep/goats that does not pay its due, on the day of resurrection they (the animals) will come to their owner in the best state of health they have ever had (in the world) and they will butt him with their horns and tread him with their hooves. [Definition of hoof: a horny covering of the feet of certain animals] and whenever the last of the herd is through, the first starts all over again. (And this will continue) until (all) mankind have been judged.” – Source: Saḥīḥ al-Bukhāri: Ḥadīth 1460 vol.1, page 322

The scholars agreed paying Zakāt through livestock – camels, cattle, sheep, and goats. [ijmāʿ]

What are the conditions of the Zakāt of Livestock?

Notes: A working animal, such as one that carries goods, ploughs the land, produces milk or reproduces etc, is not applicable for Zakāt, even if they are free grazing according to the Hanafiyya, Shāfʿiyya and Hanbaliyya schools of thought [maḏhāhib].

- Contrarily, Imām Mālik states the working animal can still be used to offer Zakāt. [Tabarānī Ḥadīth]

- Another condition Imām Mālik has added is that the shepherd must have reached the age of maturity [bāligh]. If in the case of no other shepherds looking after the livestock, the livestock is not payable for Zakāt but should wait for a whole year.

- As- Ṣawm – the food the livestock eats from is wild plants (free grazing). If food is brought to them, so they are fed, Zakāt is not applicable.

Definitions of ṣāʾimah (taken from the word al- ṣawm): This refers to an animal that is free grazing from wild plants and this is enough for it, so it does not need to be fed. [Hanafiyya, Mālikiyya, Shāfʿiyya, Hanabala].

- Imām al-Shāfiʿī: The Zakāt should be given from those who graze freely most of the year, even if they were fed a little. However, if the feeding is more than the free grazing [ṣāʾimah] Zakāt is not applicable.

- Imām Abu Hanifa & Imām Ahmed bin Hanbal: Ṣāʾimah is the one that is sufficiently grazing from the wilderness. If the owner feeds it, either half or more than a year, it is not considered ṣāʾimah, thus Zakāt is not applicable.

- Imām Mālik: It does not matter whether it is fully free-grazing [ṣāʾimah] or half – you still have to give Zakāt – why? Because there is no word relating to free-grazing [ṣāʾimah] in the ḥadīthliterature because the Arabs had nothing but thatfor their animals

- There is disagreement about the duration of the free grazing [ṣāʾimah] that makes it compulsory for Zakāt.

Working animals that are used to carry heavy loads/goods, or to lift or plough the ground do not need to have Zakāt paid on them, even if they are free-grazing (according to the Hanafiyya, Shāfʿiyya and Hanabala schools).

According to the Mālikiyya school [maḏhab]: Working animals will not stop the individual from giving Zakāt.

- New-born livestock are excluded from the condition of the completion of a full year [Al-Hawl]. If they give birth during the year, a full completed year doesn’t apply, Zakāt is paid when the Zakāt for the mother is due.

THE NISĀB OF LIVESTOCK

- Livestock [Al-ʾAnʿām] = camel, cattle, sheep & goat

CAMEL:

| NUMBER OF CAMELS | ZAKĀT PAYMENT |

| 5 – 9 | One sheep/goat [SHĀH] – Must be a 1-year-old sheep or a 2-year-old goat |

| 10 – 14 | Two 1-year old sheep or two 2-year-old goats |

| 15 – 19 | Three 1-year old sheep or three 2-year-old goats |

| 20 – 24 | Four 1-year old sheep or four 2-year-old goats |

| 25 – 35 | One 2-year-old camel that has not entered its 2nd year – BINT MUKHĀḌ |

| 36 – 45 | One camel that has not entered its 3rd year – BINT LABŪN |

| 46 – 60 | One female camel that gone into its 4th year – HIQAH |

| 61 – 75 | One female camel that has gone into its 5th year – JADHʿAH |

| 76 – 90 | Two BINT LABŪN |

| 91 – 120 | Two HIQAH |

| 120 + | For every 40 camels, you give one BINT LABŪN. For every 50 camels – You give one HIQAH. |

| 170 + | After two years, in every year, you give: 3 BINT LABŪN, and 1 HIQAH. 3 BANĀT LABŪN [120], and 1 HIQAH [50] = 17 |

Narrated Anas: When Abu Bakr; sent me to (collect the Zakāt from) Bahrain, he wrote to me the following: — (In the name of Allah, the Beneficent, the Merciful). These are the orders for compulsory charity (Zakāt) which Allah’s Messenger ﷺ had made obligatory for every Muslim, and which Allah had ordered His Apostle ﷺ to observe: Whoever amongst the Muslims is asked to pay Zakāt accordingly, he should pay it (to the Zakāt collector) and whoever is asked more than that (what is specified in this script) he should not pay it; for twenty-four camels or less, sheep are to be paid as Zakāt; for every five camels one sheep is to be paid, and if there are between twenty-five to thirty-five camels, one Bint Mukhāḍ is to be paid; and if they are between thirty-six to forty-five (camels), one Bint Labūn is to be paid; and if they are between forty-six to sixty (camels), one Hiqqa is to be paid; and if the number is between sixty-one to seventy-five (camels), one Jadhʿah is to be paid; and if the number is between seventy-six to ninety (camels), two Bint Labūns are to be paid; and if they are from ninety-one to one-hundred and twenty (camels), two Hiqāts are to be paid; and if they are over one-hundred and-twenty (camels), for every forty (over one-hundred-and-twenty) one Bint Labūn is to be paid, and for every fifty camels (over one-hundred-and-twenty) one Hiqah is to be paid; and whoever has got only four camels, has to pay nothing as Zakāt, but if the owner of these four camels wants to give something, he can. If the number of camels increases to five, the owner has to pay one sheep as Zakāt… [Saḥīḥ al-Bukhāri 1454i: Book 23, Ḥadīth 57, vol.2, Book 24, Ḥadīth 534]

Cattle:

| NUMBER OF CATTLE | ZAKĀT PAYMENT |

| Less than 30 | No Zakāt |

| 30 – 39 | One cow that has reached 1 year – TABĪʿ |

| 40 – 59 | One cow that has reached 2 years – MUSINNAH |

| 60 – 69 | Two cows that have reached 1 year – TABĪʿĀN |

| 70 – 79 | 1 TABĪʿand 1 MUSINNAH |

| 80 – 89 | 2 MUSINNAH |

| 90 – 99 | 3 ATBIʿAH [plural of TABĪʿ] |

| 100 – 109 | 1 MUSINNAH and TABĪʿ |

| 110 – 119 | 2 MUSINNĀT and 1 TABĪʿ |

| 119 + | For every 30 cows give 1 TABĪʿ, and for every 40 give MUSINNĀT |

Mu ʿādh bin Jabal (RAA) narrated, ‘When the Messenger of Allah (ﷺ) sent him to Yemen, he commanded him to take a tabīʿ (young bull) or tabīʿah (young cow, which is one year old), as Zakāt for every 30 cows. And for every forty cows, a musinnah (two-year-old cow) is due. Every non-Muslim who attained the age of puberty should pay one Dinār or the equivalent from the Muʿāfiri clothes (made in a town in Yemen called Maʿāfir).’ – Source: Related by the Five Imams and the wording is from Aḥmad: [Book 4, Ḥadīth 3; Book 4, Ḥadīth 625; Book 4, Ḥadīth 600]

SHEEP & GOAT:

| NUMBER OF SHEEP & GOAT | ZAKĀT PAYMENT |

| Less than 40 | No Zakāt |

| For every 40 | It is compulsory to give 1 |

| 41 – 120 | One 1-year old sheep or one 2-year-old goat |

| 121 – 200 | Two sheep |

| 201 – 300 | Three sheep |

| 300+ | For every 100, you give one sheep |

It was narrated from Ibn Shihāb, from Sālim bin ʿAbdullah, from his father, from the Messenger of Allah: Sālim said: “My father read to me a letter that the Messenger of Allah (ﷺ) had written about Sadaqat before Allah caused him to pass away. I read in it: ‘For forty sheep, one sheep, up to one hundred and twenty. If there is more than that – even one – then two sheep, up to two hundred. If there is one more than that – even one = then three sheep, up to three hundred. If there are many sheep, then for each hundred, one sheep.’ And I read in it: ‘Separate flocks should not be combined, and a combined flock should not be separated.’ And I read in it: ‘And a male goat should not be taken for Sadaqah, nor a decrepit nor defective animal.’” – Source: Sunan Ibn Mājah 1805: Book 8, Ḥadīth 23, Vol. 3, Book 8, Ḥadīth 1805

Part 3: Zakāt of Crops & Fruits

Agricultural produce, such as crops, and fruits are subject to Zakāt. This is mentioned in the Qurʾān, Sunnah and consensus [ijmāʿ]’.

“You who believe, give charitably from the good things you have acquired and that We have produced for you from the earth. Do not give away the bad things that you yourself would only accept with your eyes closed: remember that God is self-sufficient, worthy of all praise.” – Qur’an: The Cow [Baqarah] 2: 267

It was narrated from Salim, from his father, that the Messenger of Allah (Peace be upon him) said, “For whatever is irrigated by the sky, rivers, and springs, or draws up water from deep roots, one-tenth. For whatever is irrigated by animals and artificial means, one half of one-tenth.” – Source: Sunan an-Nasāʾī 2488: Ḥadīth 54 vol.3, Book 23, Ḥadīth 2490

The scholars agreed it is compulsory to give Zakāt from crops and fruits – ijmāʿ [Mālik al Mudawana, 294/1]

However, although the scholars agreed upon crops and fruits as payable Zakāt, they differed on the types of crops and fruits. The great imams رحمة الله عليهم, Imām Mālik, Imām al-Shāfiʿī and Imām Aḥmad bin Hanbal all agreed it is obligatory to give everything that you can eat and store as a form of Zakāt.

SECTION 4 – The Resources [Mawārid] of Zakāt and its entitlement:

Part 1: The Resource of Zakāt and the way to expend it

The amount of goods for Zakāt in Islam is great and varies. However, we are not liable to pay Zakāt until specific conditions are fulfilled. There are conditions upon the person giving the Zakāt, and conditions upon their wealth.

The conditions of the person giving Zakāt:

The conditions of the wealth Zakāt is taken from:

- Absolute ownership – that the individual has complete ownership of the wealth allowing them to benefit from it.

- Growth – that the wealth grows in a way that will profit the owner.

- Freedom from debt – that the wealth is free from debt, particularly compulsory Zakāt ul-ʿayn – such as, gold, money etc. There are different opinions on this in the four schools [maḏhāhib]. For example, in the Hanafi Maḏhab, a person must pay Zakāt if their wealth, after deducting immediate debts, exceeds the minimum threshold [nisāb]. On the other hand, the Māliki Maḏhab states that debts do not exempt a person from paying Zakāt even if they reduce the person’s wealth below the minimum threshold [nisāb].

- Threshold [nisāb] – that the wealth reaches the threshold level for payable Zakāt. If the wealth of the individual reaches this, Zakāt becomes compulsory upon them.

- Lunar year – that there is passing of a complete year of the Islamic lunar [Hijrī] calendar before Zakāt is owed. An exception is gains from the earth/agricultural produce.

The Recipients of Zakāt:

Zakāt must be distributed to eight groups of people as commanded to us by Allah Almighty ﷻ.

“Alms are meant only for the poor, and the needy, and those who collect them, and those whose hearts are to be reconciled, and to free captives and the debtors, and for the cause of Allah, and (for) the wayfarer; a duty imposed by Allah. Allah is Knower, Wise.” – Qurʾān: Repentance [Al-Tawba] 9:60

REFERENCES:

Dr Nawal al Maghrebi

Bewley, A. & Abdalhakim-Doughlas, A. [2001] Zakāt: Raising A Fallen Pillar. Black Stone Press, Norwich (UK).

![The declaration of [shahāda] iman biallah](https://islammyreligion.com/wp-content/uploads/2025/11/IMAN-BIALLAH.jpeg)

![God: Great is His Majesty], created angels from light. 7b72a5be 2a06 40e2 9586 e82b3d184e76](https://islammyreligion.com/wp-content/uploads/2025/11/7b72a5be-2a06-40e2-9586-e82b3d184e76-edited.jpg)